Financial Automation for Medicaid Providers

Track revenue in real time. Eliminate billing bottlenecks. Get paid faster—with fewer errors.

.png)

Thrive with Statewise — From Agency Owners to National Leaders

Whether you serve 10 individuals or 10,000, Statewise is built to scale with your agency while keeping your workflows simple and your care exceptional.

Automate Claims. Accelerate Cash Flow.

Let your team focus on collections, not clerical work.

Let Your Billing Team Focus on What Pays Off

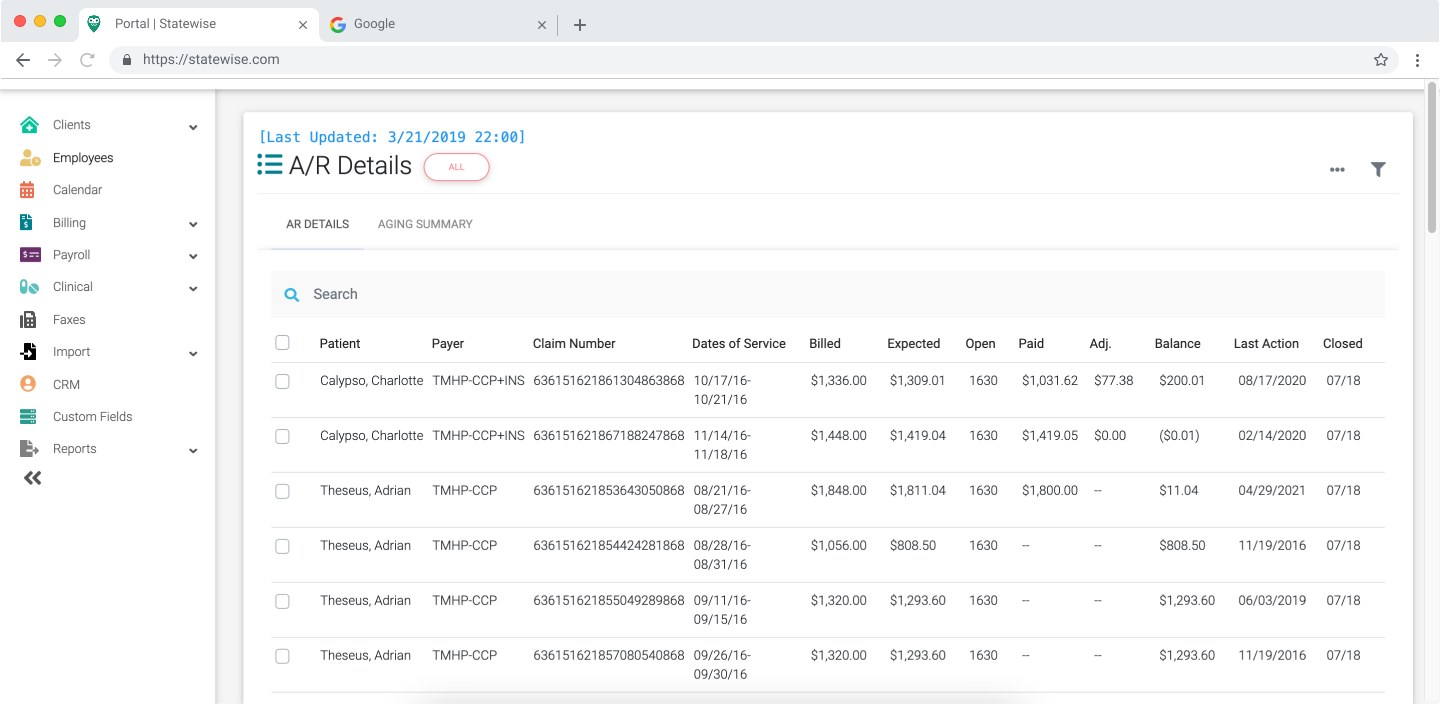

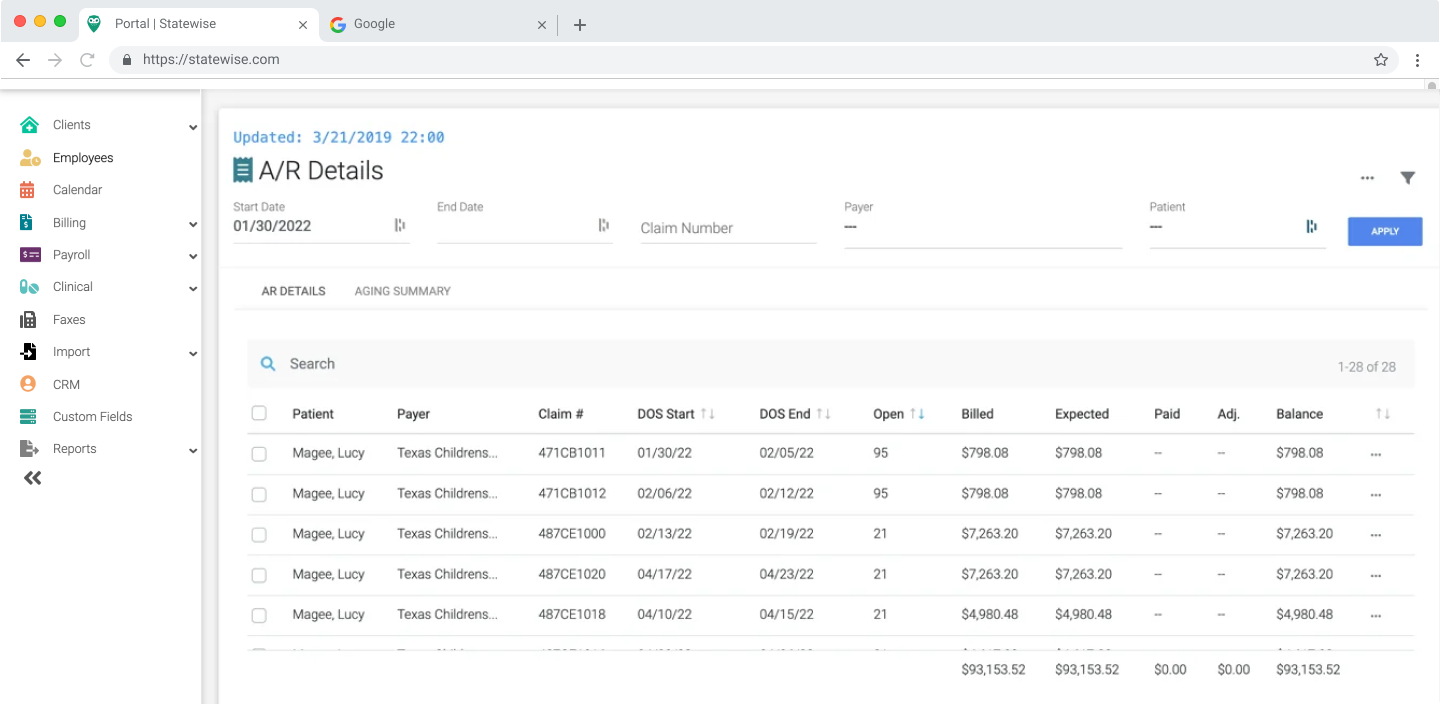

Automated claims and A/R tracking save hours of manual work, helping your team shift from chasing down data to maximizing collections. From error-free claims to real-time payment visibility, Statewise simplifies what used to be painful.

- Automated Claims: Instantly generate and submit clean, complete claims—no double entry.

- Revenue Visibility: View outstanding balances, payment statuses, and follow-ups in one place.

- Faster Collections: Focus staff energy on strategic collections, not clerical busywork.

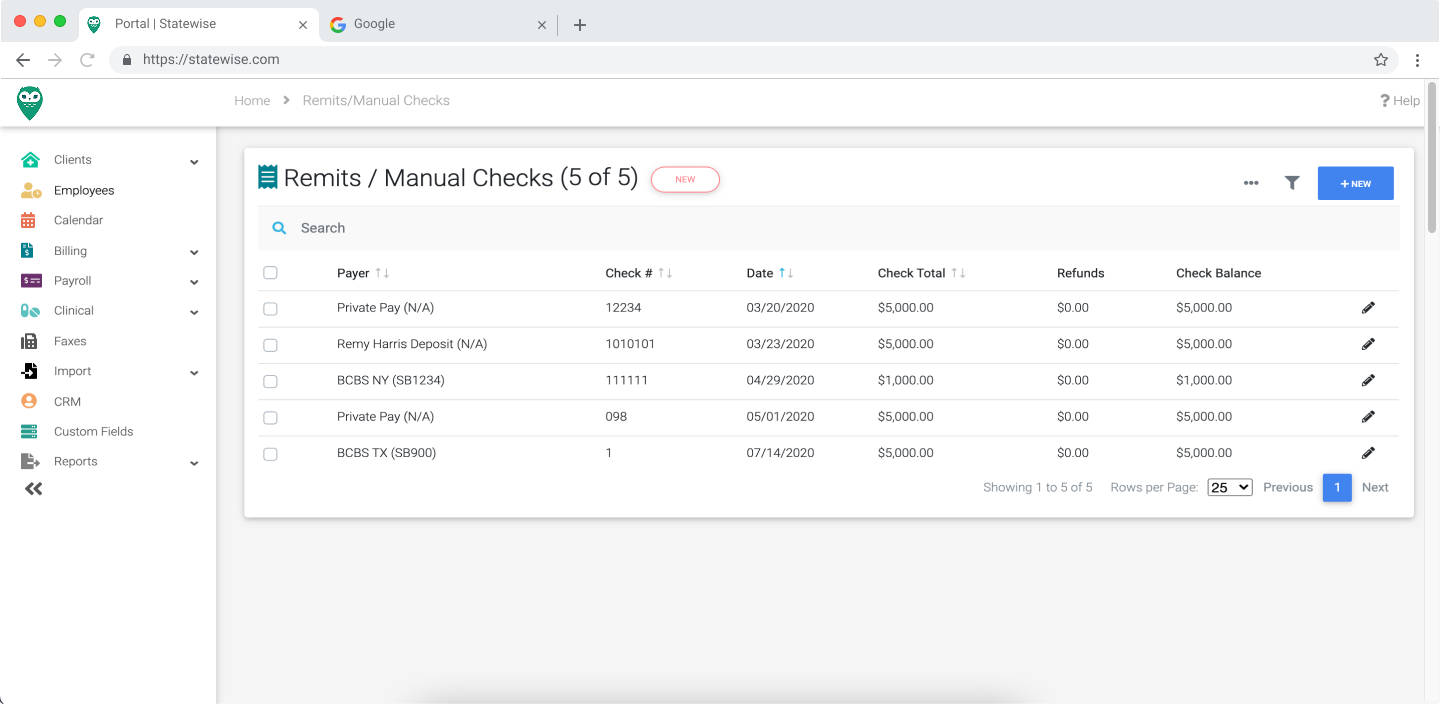

Faster Payments, Less Manual Work

Statewise matches remits (EOBs) to claims automatically—no more manual reconciliation. Whether it's a recoupment, interest, or cash deposit, our tools post payments instantly so your team can focus on high-value tasks instead of data entry.

- Auto-Match Payments to the right claims

- Reduce Admin Time by eliminating manual posting

- Speed Up Reimbursement with fewer errors and delays

Know What You’re Really Making—In Real Time

Statewise gives you the financial clarity you need—automatically generating key accounting data like profit and loss summaries and balance sheets. Just export and plug into your accounting software.

- Clear Profit Visibility: Know exactly what’s coming in—and what’s going out

- Smart Cost Tracking: See your true operating costs across programs

- Faster Reporting: Eliminate guesswork and get clean financials fast

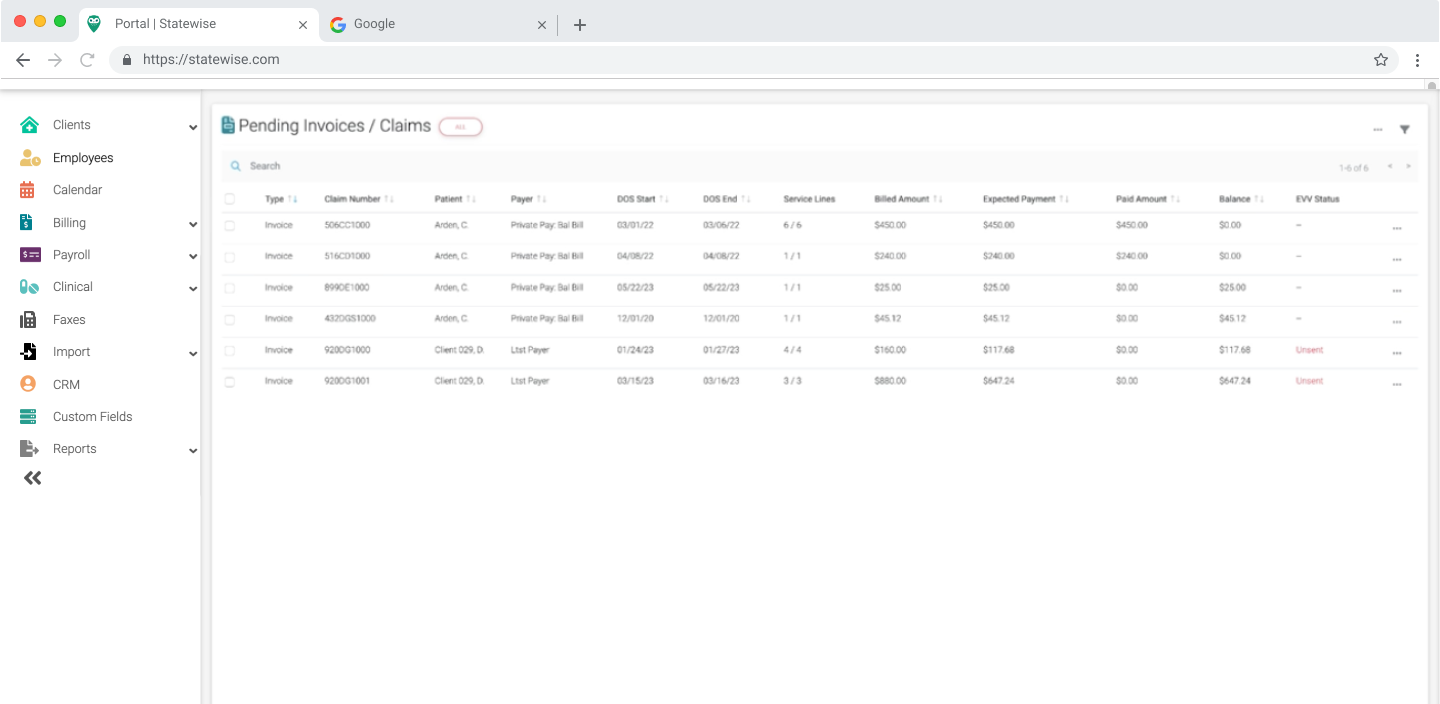

Track Claims with Clarity and Control

Manage the full claims lifecycle—from creation to status checks—all in one simple, customizable view. No jumping between tabs or tools.

- Everything in One Place: Centralized dashboard for claims, billing, and collections

- Customizable Fields: Tailor the view to fit your agency’s exact processes

- Faster Follow-Up: Instantly identify claims that need attention

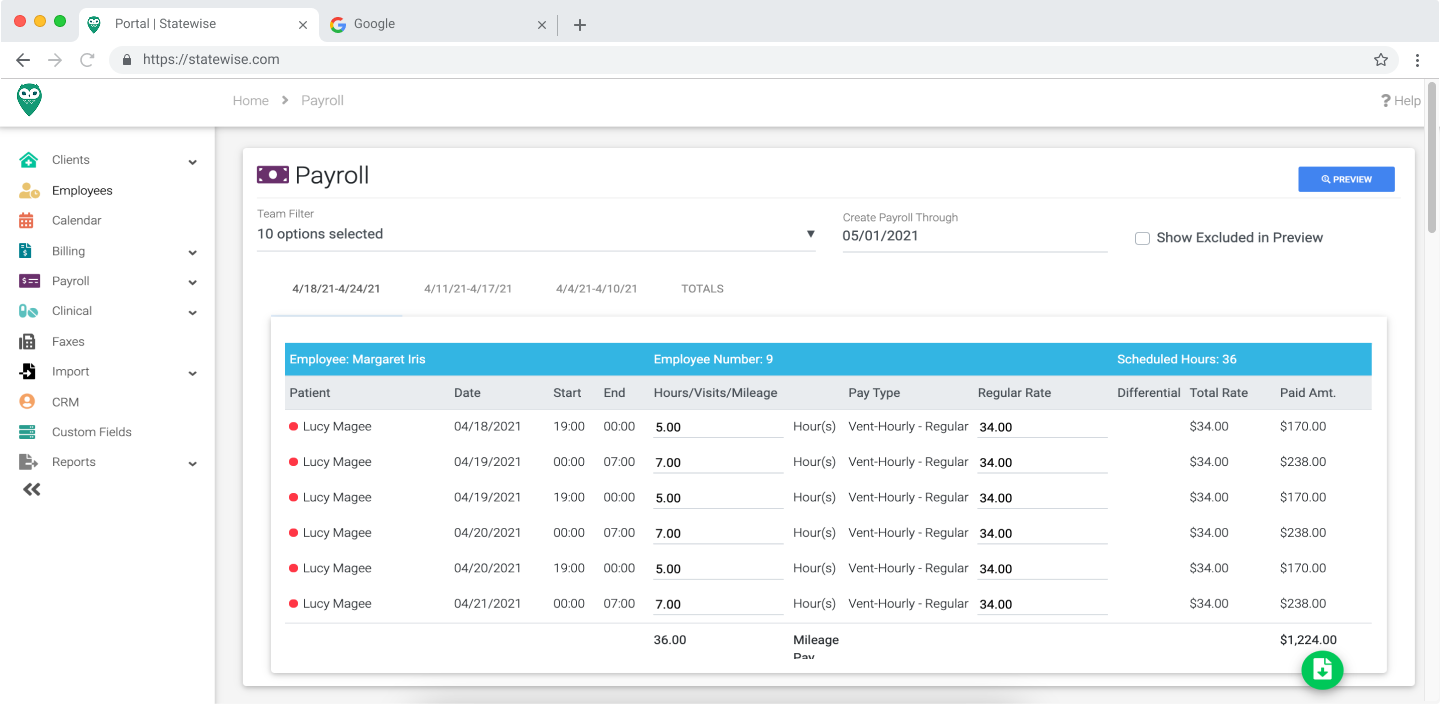

Accurate Payroll, Without the Headaches

Stop spending hours chasing down errors or adjusting overtime. Statewise verifies visits automatically and integrates with payroll providers like ADP and Paychex to streamline every pay run.

- Auto-Verified Visits: Ensure only approved visits make it to payroll

- Built-In Rules: Holidays, overtime, and differentials are calculated for you

- Fewer Errors: Reduce risk of under- or over-paying staff

Discover More Features

Mobile App

Charting

- Eliminate paperwork

- Boost accuracy and reduce errors

- Equip staff with easy tools that improve retention and care delivery

Scheduling

Optimization

- Align Shifts with Authorizations

- Avoid gaps, overlaps, and overtime

- Boost staff satisfaction and retention with better workflows

Intuitive

Workflows

- Simplify day-to-day tasks

- Reduce administrative burden

- Onboard faster, stay compliant, and scale with confidence

Frequently Asked Questions

Can Statewise help us reduce denied claims?

Yes! Our system flags authorization issues and documentation errors before claims are submitted, so you catch mistakes early and protect your revenue.

Will your software work with our existing payroll or accounting platform?

Absolutely. We integrate with major tools like ADP, QuickBooks, Paychex, and more, making it easy to pull clean numbers from our system into yours.

Can I track claim status in real time?

You can. Our dashboard shows exactly where each claim stands—from submitted to paid—so you don’t have to chase down answers.

How do I know if my agency is staying within authorization limits?

Built-in alerts notify you when you're close to exceeding authorized hours, and block overages from being billed without approval.

Does your system calculate different pay rates like overtime or holiday?

Yes. Differential pay is automatically calculated based on visit details, saving your team time and avoiding payroll errors.

Subscribe to our newsletter

Get insights into industry trends, company updates, and more.

.png?width=200&height=148&name=tshc-stacked-logo-color%20(1).png)

.png?width=200&height=140&name=Untitled%20design%20(41).png)

.png?width=200&height=140&name=Untitled%20design%20(30).png)

.png?width=200&height=140&name=Untitled%20design%20(27).png)

.png?width=200&height=195&name=Untitled%20design%20(38).png)